I am going to save you about 100 years of research, put you in front of the line and break down exactly what crypto currency is and how you can benefit from it. It wasn’t long ago that I was working a 9 to 5 making someone else rich but after failing a million times I only needed to get it right once, and I got it right with crypto, 1.3M dollars right…Listen up and you will learn how to do the same thing with my proven strategies…which I am going to give you right now…

Crypto Currency Is The Answer

There are 609 government-issued currencies that existed 500 years ago that do not exist anymore. Today we have 195 countries in the world and 193 government-issued. The point that I am trying to make is that much similar to the 609 dead currencies there are hundreds of crypto currencies that have failed, are failing, or will fail. The first lesson to learn is knowing what to invest in or what NOT to invest in. If you had invested just $1 in Bitcoin in the first three months and held it until January of 2018 you would have grossed over $333,000. Sounds crazy but there are many massive reasons that contributed to Bitcoin becoming such a valuable currency; the same can be said for many crypto currencies.

What we need to start with is looking at why crypto currency actually exists and what gives it value. Bitcoin was invented in 2009 as a way to create a currency that could exist without 3rd party regulation (banks, credit unions, or government presence). Many idiots like to think that crypto currency is best used for criminals because some currencies are private, or in other words transactions are not traceable. Let me pin these idiots against the wall for a second and show you why crypto currency makes more sense than the credit card in your wallet (the debt you carry in your pocket)…

Banks: $35 wire transfer fee (this is where they make you pay to send your own money from your bank account to someone elses. Typically these transfers take 3 to 5 business days. This is because the common practice in the banking industry it to float their client’s money and invest it in a fund they can earn a bit of quick interest in then send it off to the recipient).

-$35 overdraft fee. They actually want you to have the option of over-drawing your account so they can charge you for the first transaction that puts your account negative as well as every subsequent transaction that continues pulling your account farther into the negatives until you have deposited enough money to offset that.

-Minimum withdrawal amounts: You can’t withdraw less than $20 out of an ATM and if it is not your bank then you will pay a $2.50 to $6 fee to take the money out.

Crypto currency was created to give EVERY citizen of the Earth a solution to put the banking power into their own hands. There are 7.9 billion people on Earth of which 39% do not have bank accounts. This means that over 3 billion people on Earth do not have a bank account. Upon closer examination you will find that 17% of this population consists of babies not even half way out of the womb, children, and people “under age” according to their government’s laws. The number you have left is an astounding 2.55 billion people who do not have a bank account because they can’t afford to have one, the fees cost more than the actual money they have to deposit, and often times because the economical status of their country does not offer a viable banking option for them.

With crypto currency you now have a way for 2.55 billion people to be in full control of their own money and you have an entire new economy created made secure by any one of the 7.9 billion people on Earth who want to be a part of it. You can send and receive amounts less than a dollar in most cases, $35 wire fees do not exist, there are no minimum balance requirments, and transactions can be as instantaneous as the snap of a finger.

Okay, so now you can see where the demand comes from…but it gets even better. By 2018 there were over 1,350 different crypto currencies, each of which was created with a particular purpose in mind. We won’t go into all of them obviously, but we will talk about a couple to give you a better idea of how and why they have made so many investors so much money (once again, $1.3M for me at this point)…

Types Of Crypto Currency

Bitcoin: Think of supply and demand. Above I explained the “why” behind crypto currency. Well the “why” made sense to a large portion of those 2.55 billion people we talked about and for investors it made sense because they saw the demand. As Bitcoin gained popularity and adoption the price went up. We have all learned about supply and demand; if there is more demand for a particular asset than their is a supply it becomes a rare asset and becomes valuable; think about oil, diamonds, gold, platinum, etc. Well, there are only 21 million Bitcoins…and as people started using Bitcoin as a store of value, as a way of banking, as a way of conducting business from business owner to customer and vise versa without the need for a bank it became an asset in great demand. If the supply is NEVER going to increase and the demand continues to rise then the value goes up. So not only was Bitcoin the first financial solution in crypto currency, but it has also been the most widely adopted as of now and most highly valued.

Ethereum: Ethereum is one of the most in-demand coins out there. And this is where I want to share a different angle on how many developers of crypto currency have shaped the industry. Ethereum has worked very hard to be better, faster, and more versatile than Bitcoin; arguably it is. Bitcoin confirmations take an average of 10 minutes and can sometimes take hours to happen (still way better than a week with a wire transfer) while ETH transactions take less than 20 seconds. Ethereum is also a market coin (just like Bitcoin); meaning much like how you can buy a stock with cash, sell it at a profit, and get paid back in cash you can do the same with ETH; buy other crypto currencies with ETH and sell them at a profit back into ETH.

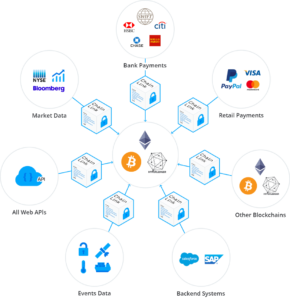

But the developers of Ethereum wanted to back up their crypto currency with more than just a virtual asset that you can’t actually hold in your hand. So when over 300 companies started using ETH and ETH technology people started paying attention. Intel, Accenture, Microsoft, Mastercard, Shell, Hewlett Packard, and other Fortune 500 companies are part of the EEA (Enterprise Ethereum Alliance). You see, there is this thing called “blockchain” and blockchain is simply a process of digitally sending any type of data electronically across a network that has to be in 100% agreement at all times for anything to happen. In crypto currency it is used to validate the sending/receiving of crypto currency transactions. Ethereum decided to create a solution for companies, start-ups, entrepreneurs, and business owners that would allow them to send Smart Contracts (paperless contracts) through Ethereum blockchain. This creates a way for important and confidential data to be stored, kept secure, and for agreements to be signed without possibility of any tampering, lying, cheating, or stealing. So you can see why it has been extremely important for people not to mention companies with hundreds of millions of dollars to use. And since companies with hundreds of millions of dollars use ETH and ETH technology, well, you can understand why Ethereum has rocketed from being worth just dollars to hundreds of dollars and beyond! But ETH is not the only currency that has created such massive solutions like this…

Syscoin: Much like ETH, SYS developers wanted to solve a massive problem in a massive industry for hundreds of thousands of business owners. So what they did was use a coin that they created to fund solving this problem. Do you see what I just said?…They created a coin, investors invested and in exchange they were given xyz amount of Syscoin. The developers of Sys then used those investments to create ecommerce solutions for business owners facing hefty fees on platforms such as Shopify, Amazon, or Ebay. This platform is called Blockmarket. As Blockmarket started being used (or adopted) and it started working extremely well for merchants selling their products, investors of Syscoin started seeing the value of their coins rise thus creating an opportunity for them to sell out of that coin and make some money! This is a common practice in crypto currency; the developers introduce the problem, show how they are going to solve it, crowdfund the solution by offering investors a crypto currency in exchange for their investment, and if the project is successful then the coin will raise in value as the success continues. Of course success is not always the case and there are many shit coins (yeah, that’s a term we give to coins that are literally extremely shitty investments).

So what is a shit coin? A shit coin is a coin that has little to no use or purpose. Dogecoin would be an example. This is literally a coin named after a Japanese dog meme. It was designed as a tipping coin; a pat on the back, a “good job buddy” sort of coin. It has absolutely no utilitarian use and no place in business. Every single spike in the market with Dogecoin has happened because it has always been an extremely cheap coin (because it has no worth lol) and people with large amounts of crypto currency have bought it to drive the market up and then dump at the top to make profits…but if you’re looking for a coin you can count on to be here tomorrow, next week, next month, or next year, Doge is not it. And that’s the thing, coins can actually get de-listed from exchanges (platforms that you use to buy and sell much like you would use an Ameritrade account to trade stocks). Moral of the story; there are good coins and bad coins so it is important to do coin research and know what you are investing in. You wouldn’t invest in Putin coin would you?…Yes that is real.

7 Things To Help You Profit With Crypto

Okay so what else do you need to know? Well I could keep going but it’s time to make some damn money. When I am going to invest in a particular coin here is what I look at:

- Purpose: What was the “coin” made for? What problem was it designed to solve?

- Adoption: Based on the purpose, has it been adopted? Has it caught on popularity for a good reason?

- Development: Throughout the history of the coin has it had a development team that is dedicated to the success of the coin? Are they dedicated enough to keep the progression of the vision going year after year after year?

- Networking: Is the company/dev team that created the asset networking with already existing companies to partner up and see the asset further adopted into industry?

- Market History: What has history in the coin proven? If we look at the charts, do we see multiple significant bull markets? Do we see several good profit opportunities?

- Personal Taste: This is the one area where we may differ. If I don’t like the coin’s purpose, if I don’t like the dev team, if I don’t like the UI of their website, then I am not investing in it.

- When is a good time to enter? Is the coin at an all-time high or fairly low compared to its market history? You obviously do not want to enter into a market high.

One last word of advice; don’t show up to a gunfight without all your bullets. You need to have all the tools in your belt so you can go make your millions. I want to give you access to every single strategy, tool, and tactic I have used to turn my $3,500 into over $1.3M. The best part is that some will make more with less, it wouldn’t be the first time and it sure as Hell won’t be the last. Click the link below and let’s start earning crypto together! See you at the top of the charts!

Start earning crypto currency now!

Andrew Fraser

30 Apr 2018Thank you Ben for that great article!

I learned a lot!

Can’t wait to work with you!

ben

3 May 2018Appreciate it brother!

Nicole Lyons

30 Apr 2018I was sitting here last night telling my best friend’s how important it is for me to learn about the history of money and crypro-currency. Here I am reading your blog post on it.

You’re super smart and a genius Ben.

How much information do you know about banks on the in’s and out’s it jsut as inpoetnsnt to me because I want to share the same value you give. If you can lead me in the right direction. I will drive there. I have strong will to remember whats valuableband important to share.

ben

3 May 2018Thank you Nicole! I appreciate you and how closely you follow everything! Reach out anytime!