2017’s rise to a $20,000 Bitcoin was pushed entirely by private money, absent of government envolvement. What it did do was finally catch their attention after nearly 10 years since crypto currency’s inception and whether you like it or not you can thank the majority of 2018’s blood bath to Uncle Sam. Bold statement I am making here?…Not really, let’s talk about how the United States Government owns Bitcoin.

Taking Crypto Way Back

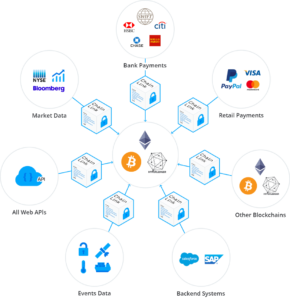

Crypto was launched privately by arguably one of the most anti-regulatory person in the financial industry, Satoshi Nakamoto; the creator of Bitcoin. The whole premise behind Bitcoin was to enable Party A and Party B to conduct business amongst themselves without the need of a middle man, or in other words “a bank.” Many unintelligent fuck sticks seem to think that crypto was created for criminals, porn starts and law-breakers. In reality criminals use fiat currency, crypto, gold, precious metals, or anything that serves as a store of value. Bitcoin was simply created to alleviate the need for 3rd parties (banks), minimize lag time, fees, and chargebacks.

They laughed at us when we said we were creating a digital currency that was entirely electronic, computer-generated, and was not government-created. Ultimiately we were massively under-estimated and largely ignored until we started to gain traction….

Think about it; we went entirely unregulated, ignored, and laughed at…until we hit $20,000. Every single crypto market from 2009 (the start) through the end of 2017 was triggered entirely off of private money, independent companies creating these coins and technologies, and private investors turned crypto currency whale.

The United States Government’s Involvment With Crypto Currency

In 2017 pretty much every country said, “hey, now we care.”…

In December of 2017 Iran’s HCC says they like crypto but it will be HEAVILY regulated.

December 6th of 2017 South Korea bans Bitcoin Futures (maybe because they noticed they missed the bandwagon by not investing in BTC early…)

And then comes the United States: By definition, the SEC regulates all securities; including Bitcoin in cases where the virtual currency doubles as an investment vehicle, such as a stock. Yet the SEC did not start scrutinizing Bitcoin until they saw the opportunity to regulate all United States-incepted ICOs in the first quarter of 2018. This is where it gets good.

On December 10th of 2017 Bitcoin Futures start trading in the United States. The first ones expire on January 26th (if you recall Bitcoin hit an all time high on December 18th and then dropped 50% in value by January 26th. Hmm, kind of ironic don’t you think?

If I am the United States government and I have spent the last 8 years ignorning the fact that people are trying to conduct business absent of debt, loans, and fees and then I see a multi-million dollar profit that I missed out on I might get a little butt hurt. So in the midst of the first US-based Bitcoin Future launch I decided to start stiring up news about Bitcoin; unclarity about how it will be taxed, if it will be regulated, what’s legal and what’s not, and I might get the SEC involved as well as the IRS.

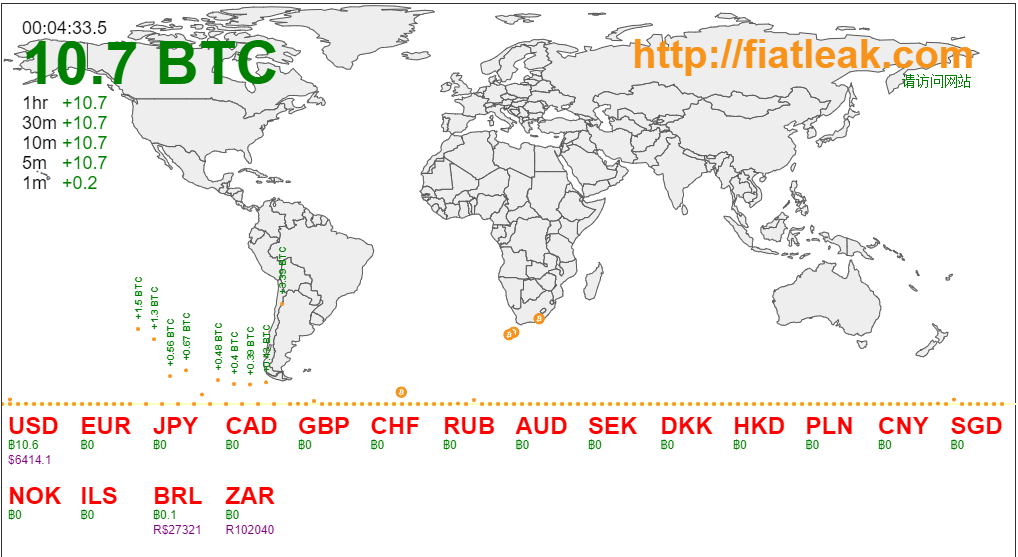

As an early investor I get scared, then I see China follow suit and ban trading, I see a hack happen on a Japanese exchange for $50M worth of XEM, and the rest of the year continues to be an absolute blood bath. With all of this being said the irony continues as China no longer is the number one circulator of Bitcoin; instead, the United States takes the podium.

What’s The Future Of Bitcoin

Let me be clear, I love America, I love where I live, I am blessed to be here, and I love the United States. With that being said, every government has some level of corruption; some have more, others less. The goverment is a business too; if I have the opportunity as a government to chip away at my $19T deficit or take an easy profit why wouldn’t I?

The early believers and investors of extreme faith hang on to Bitcoin, Litecoin, Ethereum, XRP, and any other currencies that they strongly believe in but everyone else has jumped ship. New money and new investors will be necessary to see crypto boom again. It WILL happen but they will need a little nudge first; the United States Government will supply that nudge………………………………when they are ready. They will be ready when they decide they own enough and that they are positioned low enough to make the ROI that they desire. We do not know when this nudge will happen; positive signs point between Q4 all the way into 2019.

What we do know is what we can prove; the USA owns the most Bitcoin out of any country in the world, is the number one circulator of it (refer to the picture above), and there 80% of Bitcoin has already been mined.